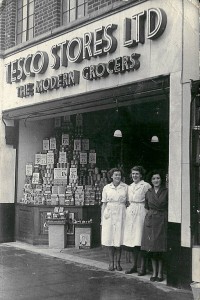

Demise of the Supermarket

Self-service supermarkets quickly established themselves in the 1960’s, catering for the relatively affluent car owner of urban society. An oligopoly market was soon established, with 5 or 6 retailers serving the food in the UK, all competing via brand advertising and discount deals rather than direct price competition. Prices remained low and did not change drastically over time.

Some 50 years on, these types of outlets are experiencing falling profits, rising costs (particularly ground rental charges) and a decline in market share to smaller outlets serving the needs of local communities and changing shopping habits. Morrisons, Tesco and Sainsbury have all seen their share price fall in recent months as they face competition from on the one hand up-market retail stores such as Waitrose, and on the other foreign discount stores such as Aldi and Lidl.

Amongst the social and economic factors driving this change in the market place are the rising cost of motoring, high cost of TV advertising, the convenience afforded by internet shopping and an increase in working hours – particularly for women who do the bulk of the food shopping. Take-away meals and eating out are more popular than large scale set meals cooked for the whole family. All this benefits the small shop rather the supermarket chains.

Competition is most severe from discounters such as Aldi and Lidl, which have doubled their sales over the past 5 years as they attract cash-strapped shoppers in times of economic austerity, job insecurity and rising mortgage payments. Staff are made redundant, but on the other hand consumers benefit from falling prices. At the high end of the market, stores like Waitrose cash in from their sale of quality products to the relevant affluent.

Internet shopping, a new and more convenient method of food distribution when almost all urban populations have access to the internet, is a key factor in the demise of the traditional supermarket outlet. By 2019 it is predicted that new players such as Amazon will have captured 8-10% of the market in the UK. But stores like Morrisons and Tesco are fighting back by investing in their own internet operations and by sub-renting floor space to businesses offering services and products other than food staples (e.g. hairdressing, beauty salons, gym space, book shops and financial services outlets).

These trends are universal across urban society from Paris to Beijing. A loosening of the hold over food retailing by the oligopoly giants in favour of high quality and discount stores seems set to continue. And for once the consumer seems set to be benefiting.